Product Metrics

Mobile product managers have a long list of Product Management Metrics to pull from when determining the success of their products. To make things easier, here are 25 of the most common:

- Downloads

- Monthly Active Users (MAU)

- Daily Active Users (DAU)

- Session Length

- Session Interval

- Time In App

- Org Creation Date

- Integration Date

- Account Launch

- Collaborator Additions

- Conversion Rate

- Churn

- Retention

- Cost Per Loyal Customer

- Tier

- Industry

- Country

- Count of Collaborators by Job Function

- Count of ios and Android Apps

- Download Revenue

- In-app Revenue

- Lifetime Value

- Quality of Features Released

- Timing of Features Released

- Team Sentiment

Mobile product managers have a long list of metrics to pull from when determining the success of their products. Although it’s great to have options, the sheer volume of metrics to choose from can make selecting the right metrics for your product challenging.

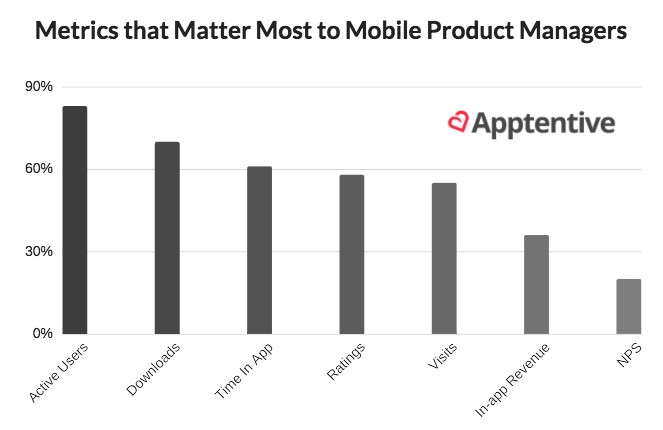

To understand which metrics most mobile product managers care about, Apptentive recently ran a survey with over 200 product managers and asked respondents to tell us which metrics matter most in their reporting process. Their answers gave us new insight into what metrics matter most as we move into the new year.

Active users (both MAU and DAU), downloads, time in app, ratings, visits, and in-app revenue were the most important metrics our respondents used in order to determine the success of their app. However, there are plenty of other metrics to pull from to determine the true health of your mobile product.

To help you select the metrics that will share the best insight into your mobile experience, we’ve listed 25 metrics many mobile product managers track, broken down by the goal the metric can help you support. A short explanation (along with calculations, when applicable) follows each metric to help you understand what it can tell you.

1. Customer Activity and Engagement

Activity and engagement metrics include many of the popular metrics mobile PMs regularly track. Most daily/weekly/monthly activities you track about your customers fall into this category.

Downloads

Downloads are the number of people who have downloaded and installed your app on their device.The most accurate way to track downloads is directly from the app stores. While downloads alone don’t paint the whole picture of success, they sure do help. Measure this metric directly from the app stores. Third-party tools like App Annie can help you crawl the app stores to get the most accurate download data.

Monthly Active users (MAU)

Monthly active users (MAU) counts the number of unique users over the course of a month. To calculate, count the number of unique users during the previous 30 days to understand how many users have been active in your product. Specifically, MAU helps you gauge the “stickiness” of your experience and can help identify trends in loyal users.

Daily Active Users (DAU)

Daily active users (DAU) counts the number of unique users in one day. To calculate, count the number of unique users during the previous 24 hours to understand how many users have been active in your product. DAU is a great metric to watch if loyalty within your mobile product requires daily use (for example, a shopping or social media app) rather than less frequent use (for example, a banking app).

Session Length

Session length is the period of time between app open and app close, or app timeout. It indicates how much time your users are spending in your app per individual session. To find this metric, calculate how long a user is in your app from the time they open the app to the time they close it. Once you have individual data, segment your users to see which groups spend more time in your app and why. Tracking the length of sessions is particularly important for unlocking revenue potential in your app flows.

Session Interval

Session interval is the time between the user’s first session and their next session. This metric shows the frequency in which users open the app and how sticky your app is. To calculate, pull the time a user has spent from when they last close your app to the next time they open it. When you know the typical time lapse between sessions per audience segment, you can use that information to optimize the customer experience to encourage more frequent app usage.

Time In-app

Time in-app tracks how long a person was in your app over a period of time. It identifies how often your app is being used and is an indicator of how valuable your app is. To calculate, select a certain time period and add all of the session lengths for an individual user during that time period. By identifying how often users engage with your app, you can identify behavior and patterns over time. If a certain segment of customers consistently opens your app for a long periods of time, dig into why.

2. Onboarding and Activation

Onboarding customers and activating their engagement is all about product adoption and ease of use. It’s crucial your customers find your product easy to integrate and begin using, and data in this category helps you understand how customers perceive your current onboarding process, along with giving insight around what you can change to make the process smoother.

Org Creation Date

This is the date a company’s account was created with your product. Many products allow multiple collaborators to engage on one account, so backtracking to find out who the first user was is critical in understanding the customer’s complete experience with your product. If the org account was created long before engagement started picking up, something was likely amiss.

Integration Date

Does your product require integration? If so, we recommend pulling its integration date to help with two primary learnings. First, look at the date the customer closed from your sales team and compare it with the integration date to get a sense of how long this phase of the onboarding process takes customers. Second, look at the integration date to the date account engagement started picking up to understand how long it took the customer to begin fully leveraging the product.

Account Launch

As mentioned above, it’s important to track the time between product integration to product launch, if possible. Your mobile product team should have an idea around the average amount of time customers take between integration and full use of the product (i.e. launch), and if a customer has fallen too far outside of the average window of time, something is likely off.

Collaborator Additions

The time it takes a customer’s main profile to add collaborators is a strong indicator of how quickly the product is adopted among a team. Additionally, it’s fascinating to go deep and to look at how different collaborators on the same account use the product, especially if they have different roles within their organization. These metrics offer invaluable insight into how different teams can leverage your product, which can help your product, sales, and marketing teams.

3. Conversion and Retention

Conversion and retention may look different at every company, but even though they can be ambiguous, these metrics offer crucial insight into your app’s overall health. We recommend working closely with your marketing team to set goals and strategies to move these metrics in the right direction.

Conversion Rate: The number of potential customers who started a trial and end up converting to paid customers in a set period of time. Conversion is most commonly measured by taking the number of leads or trials in a period of time (weekly, monthly, quarterly, etc.) and dividing by the total number of new customers added during that same period of time. By increasing your conversion rate even a small amount, you can quickly increase your customers, MAU, and revenue.

Conversion Rate

The number of potential customers who started a trial and end up converting to paid customers in a set period of time. Conversion is most commonly measured by taking the number of leads or trials in a period of time (weekly, monthly, quarterly, etc.) and dividing by the total number of new customers added during that same period of time. By increasing your conversion rate even a small amount, you can quickly increase your customers, MAU, and revenue.

Churn

A measure of what was lost during a given period of time. Churn can be in dollars, customers, unsubscribes, etc. To calculate, divide the number of customers lost in a month by the total number of users from the prior month. Once you’ve assessed your customer churn, map out how much revenue was lost (as some customers will be on different payment plans than others). Some amount of churn each month is normal as it’s inevitable that a few customers will cancel. Looking back on historical data will help you better understand how much churn is “healthy” for your team.

Retention

Retention is a measurement of customer churn that tells you how many customers continue to actively use your app in a certain period of time. Aggregate retention is best calculated monthly. To calculate, divide your MAU by the number of installs you get in a given month. To calculate retention for a specific period of time, divide the number of users retained at the end of the time period by the number of installs at the start of the time period.

Cost Per Loyal Customer

Understanding cost per loyal customer, or CPLC, helps your team with budget planning and forecasting. Calculating CPLC is similar to calculating CPC: Divide all your acquisition costs by the number of customers acquired in the same period of time the money was spent, but go the extra mile to segment customers who fall into your “loyal” bucket by segmenting by customer behavior. From there, you can better understand how to drive more loyal customers and forecast how much it will cost to get to your goal.

4. Customer Segmentation and Growth

Segmenting customers is a great way to plan acquisition, engagement, and growth strategies. We recommend looking at demographic data to start segmenting, and then coupling by the engagement metrics we covered above to expand your segments. Here are a few important demographic data sets to keep an eye on.

Tier

If your product has different customer tiers, be sure to track which tier your customer falls into when you begin segmentation. Customers from different tiers will undoubtedly use your product in different ways, and it’s important to set your expectations accordingly.

Industry

Industry standards play a huge role in how a customer will use a product, so add this field to your segmentation metrics as early as you can.

Country

Tracking a customer’s country (or geographic location if your product only sells to one country) can help you understand more about consumers, which can help you localize product features for faster adoption and higher engagement.

Count of Collaborators by Job Function

Your customers may use your product differently depending on their job function (e.g. product manager, marketer, developer, etc.) and role (administer, collaborator, etc.). Help set them up for success early by tracking what they do for their company.

Count of iOS and Android Apps

Regularly count how many iOS and Android apps each customer has to understand how many consumers your product helps them reach.

5. Revenue

Revenue goals come from the top-down, and it’s not enough to simply know how much money your mobile product is bringing in. Your CEO and leadership team is constantly iterating on the company’s revenue goals, so understanding how your mobile product fits into the grand scheme of things is imperative to gauging success.

Download Revenue (for paid apps):

The percentage of your total company revenue that comes from people downloading your app from the app stores. If your app is free to download, you can skip this metric. Find the percentage of your total revenue driven by your app downloads by dividing your app’s monthly download revenue by your MRR (monthly recurring revenue).

In-app Revenue:

In-app revenue is revenue collected from customers as they use the app from purchases, ads, unlocking levels, purchasing points, etc. This metric does not include download revenue. Find the percentage of your total revenue driven by in-app purchases by dividing your app’s monthly in-app revenue by your MRR (monthly recurring revenue).

Lifetime Value:

Lifetime value, or LTV, is the estimated total revenue from the customer over the life of the relationship. Determine customer LTV by taking the average revenue per month and multiplying it by the average lifetime of a customer in months. LTV is great at showing growth over time for different segments of your audience (by acquisition channel or by monthly cohorts, for example). This can tell you which customer segment is the most loyal, the biggest evangelists, and spend the most money.

6. Team

It’s easy to only look at numbers when calculating success, but don’t forget to look at your team’s health to understand how your mobile product is performing. It’s important to gather data on everyone involved to understand how the internal machine is movin’ and groovin’.

Quality of Features Released

This metric helps you understand how the quality of your recently launched product and/or feature compares to the quality of previously launched products and/or features. Gauging quality isn’t a perfect science, but you know the standards set by your team better than anyone. Dig deep into how you’ve rated features and products in the past, and compare those scores with your most recent release. How does it stack up? This metric is meant to help you understand what you can improve for next time.

Timing of Features Released

This metric helps you understand how “feature creep” affected your release so you can better assess what to change for next time. Look at the deadlines and release dates you gave yourself for a feature update/product release/etc. How many deadlines were hit? For the deadlines that weren’t hit, how delayed were they? Take the number of deadlines hit on time and divide them by the total number of deadlines set for the project to give yourself a percentage score. Example: If three out of my five deadlines were hit on time, my team gets a 60% feature release score out of a possible 100%.

Team Sentiment

This metric takes many different components (including individual happiness, team progress, communication, individual involvement, etc.) into consideration. It’s the least scientific metric metric you can gauge your team’s success on as “sentiment” is quite interpreted; teams (and even individuals) define happiness in different ways, and what works for you may not always work for the next group. To calculate, think about the “happiness” metrics that matter most to members of your team. Spend time with each team member and allow them to score themselves and the overall team on each metric, whether through survey, email, or in person. Once everyone weighs in, average the score for each category, then sum your averages to come up with a final score.

In Conclusion

The field of mobile product management has changed drastically over the last few years and shows no signs of slowing down. Between rapid advancements in technical skill sets and the ever-shifting needs of mobile consumers, mobile product managers are at a unique crossroads when it comes to influencing their products and impacting their company’s larger business goals

We hope our research can help mobile PMs improve their work, make better business decisions, and overall, become better at their jobs. If you’d like to see the full details of our report, you can download it here: Mobile Product Management: New Trends and Data.